What to Know About Purchasing Contractor’s Insurance, including Errors and Omissions Insurance8/15/2017 When you made the decision to open your own business as an independent consultant, you took on the responsibility of ensuring your consultancy's legal and financial well-being. As an independent consultant, you are your business. If any legal or financial problems arise that affect your business, they also affect you directly. By protecting your business against the risk of liability losses, you are protecting yourself and your future security.

What Are Your Options? Of course, the types of contractors insurance that are right for your business will vary greatly, depending on your industry, the size of your business, your client type, and other factors. Below are a few common types of business insurance that are often applicable to independent consultants. General Liability General liability insurance is often necessary for independent consultants. This insurance covers a wide range of incidents, including accidental damage to a client's property, claims of libel or slander, and the cost of defending lawsuits. Professional Liability Also known as "errors and omissions insurance," professional liability insurance provides protection in the instance of a client incurring financial harm due to an error or omission - that is, a failure to perform an integral part of your responsibility on a project - on the part of the consultant. Homeowners' Insurance You may wonder what homeowner's insurance has to do with protecting your business. While this doesn't apply to everyone, it's relevant for those independent consultants who choose to work out of home offices. Most homeowners' insurance policies do not cover losses sustained by a home-based business by default, and require specific riders added to the policy. This is especially true if clients visit your home office setting. Why Do You Need It? Some independent consultants forgo insurance in order to cut costs. However, the cost of resolving even a moderate issue, such as a contract dispute, without insurance can be far more expensive than the cost of the premiums. It can sometimes be enough to put companies out of business entirely. Protecting yourself with business insurance is not just the smart thing to do; some states may require you to have certain types of business insurance. Even if You Don't … They Do The reality is that many of your future clients will also require specific insurance coverage as a condition of hiring. By hiring you as an independent consultant and putting their project into your hands, they are placing a large amount of trust in you. Mistakes happen though, so it is important to guard against them and mitigate the client's risk as much as possible. Many procurement organizations require standardized insurances to enable set-up of a new vendor business providing services, even for very small scale projects. How Much Do You Need? Exactly how much insurance you need will again depend on your industry, the type of clients you have, and other factors. However, expect most clients to require a minimum of $1,000,000 in general liability insurance, and another $1,000,000 in professional liability coverage, so keep these numbers in mind as a starting point. Umbrella policies, which cover costs above and beyond your general liability coverage, are also generally recommended. How Much Does it Cost? You guessed it -the cost of business insurance will vary, depending on your business' income and industry, among other factors. Consider looking into BOP insurance, also known as a "business owners policy." These policies combine the coverage of a number of different policies - such as general liability and professional liability - into one package, often at a cost that is significantly less than purchasing the policies separately. Get as many quotes as you can to make sure that you get the best value possible. If you take the time to shop around when purchasing insurance, the cost may be less than you expect. You may also consider offering services via an independent contractor engagement specialist; MBO Partners, author of this blog, is one such organization. These organizations offer insurances aspart of their service package for independent business owners, forgoing the need for purchasing expensive individual business insurances before revenues can sustain it. How Do You Buy It? Business insurance can be purchased through an insurance agent or directly from the insurer. Take the time to research your options before purchasing; you may want to consider getting recommendations from colleagues or from your local chamber of commerce.

0 Comments

Becoming an independent contractor may sound great, but perhaps you don’t feel ready just quite yet. Being confident in your decision is important, and luckily there’s a lot you can do to prepare for self-employment so you feel completely informed in your choice. Building a strong networking base, preparing financially, and establishing the unique services you bring to the table will help ensure you begin your independent career ahead of the game. Follow these five steps to set yourself up for success. 1. Make Sure Independent Consulting Really is Right for You

Self-employment offers many perks including the ability to be your own boss, control your own schedule, and do what you love. However, successfully managing your own business venture does require dedication, passion, and hard work. Make sure that independent consulting is the right path for you before deciding how to proceed and prepare. 2. Build Your Network Networking to grow your business is one of the most effective ways to get a pipeline of clients in place before you start work. Honing both your networking and skills as well as your elevator pitch is helpful to build confidence, practice speaking about your services, and get advice from other industry professionals. Consider attending networking events in your industry to learn about the latest trends and to learn about what other consultants are doing and offering. Finding a mentor is another way to obtain valuable business-related guidance and advice. A mentor can be especially valuable when you’re first starting out because they can speak from experience, and provide recommendations on the steps you need to take to start your business. 3. Show off Your Skills on Social Media Creating a social media presence is helpful to stay in touch with your network, establish yourself as a trusted authority within your industry, and market your future business. Use LinkedIn as a virtual resume and as a platform to network with people you are interested in working with. Twitter and Facebook can also be used to maintain professional relationships and share interesting articles. Blogging is another way to showcase your knowledge. Starting a blog may be helpful to practice writing about topics you are considering centering your services around. Blogs can be used to educate and engage a target audience and can even lead to connections and future work. 4. Develop Your Personal Brand The public will perceive your future business through your personal brand, so developing a strong brand is an essential part to preparing to become self-employed. From your brand, future clients should be able to quickly and easily ascertain exactly what you do and what services you offer. When building your personal brand, think about what will make your business unique, and what type of messaging might be helpful to showcase those offerings. Building a brand goes hand-in-hand with marketing and developing a social media presence, so be sure to incorporate your branding and messaging across all social media channels. 5. Prepare Your Finances If or when you decided to transition to the independent workforce, you’ll want to make sure you’re in a good financial position to do so. Saving now can help you be prepared for when you start your business. It’s a good idea to have a cushion of several months’ income so when you do start working you have some time to secure future projects. Thinking about what your bill rate might be before you start work can help you set financial goals and expectations. Your bill rate is the foundation on which you’ll build your business, so determining this amount ahead of time will provide peace of mind. With these resources in hand, you’re well on your way to becoming a successful independent consultant. If you have any additional questions such as how to structure your business, how to handle tax withholding, or what retirement and health benefit options look like, MBO Partners is a great resource. We have answers, so don’t hesitate to reach out to us with your questions! Tracking and billing time is an inevitable task for independent consultants. Whatever billing method you choose, you want to present a reputable, professional invoice to your clients.

Billing Policy Establish billing policies and procedures for your solo business. Your billing policy should include: rates, billing method (paper or electronic), timing of invoicing (weekly, monthly, at project end), time to pay, preferred payment method, and late fees. Having a standardized set of rules will simplify your billing and help as you evaluate client contracts. However, even with an established policy some client contracts may differ. In addition to having your own, it is critical to understand your clients' billing policies. Make sure that policies are outlined up front so that you can present a bill that is compliant. For example, some clients may require a paper invoice and a longer time to pay than your standard billing terms. Knowing that in advance, will allow you to make the appropriate adjustments or negotiate the terms with your client before you bill. Client Friendly Process Remember your audience when preparing invoice. You may or may not know the client contact reviewing your bills. In some cases there may be multiple levels of review or invoices may be processed by a third party vendor. Avoid the use of industry jargon or abbreviations in your descriptions so that anyone reviewing will understand what is being billed. Track Your Time Even if you bill by the project or month, it is always a good idea to keep a record of time spent on client tasks. As a best practice always record your time immediately. This will ensure that your records are both up to date and accurate. You can track time using time and billing software, apps for your smartphone or even a simple notebook. The Invoice The detail of your invoice may vary by industry or client requirements but it is important to include:

To avoid billing conflicts, always have a signed agreement on file that articulates the billing process and terms. In some countries you are required to use the words "Tax Invoice." Be sure to confirm invoicing requirements with your local tax authority. Billing Methods When it comes to preparing professional invoices, you have a number of options. You can create a simple invoice template using Word or Excel. This is an easy, low cost process. Alternatively you can use time and billing software such as QuickBooks or cloud-based services such as Freshbooks or even PayPal to prepare and send client invoices. Many programs also offer apps that allow you to manage billing and payment from your mobile device. Banks and credit card companies today also offer invoicing services for their small business customers. Whether you choose to bill by paper or electronically, remember that every client touch point reflects your brand - including your invoices. Always present invoices that are accurate, timely and free of errors. Tracking and billing time is an inevitable task for independent consultants. Whatever billing method you choose, you want to present a reputable, professional invoice to your clients.

Billing Policy Establish billing policies and procedures for your solo business. Your billing policy should include: rates, billing method (paper or electronic), timing of invoicing (weekly, monthly, at project end), time to pay, preferred payment method, and late fees. Having a standardized set of rules will simplify your billing and help as you evaluate client contracts. However, even with an established policy some client contracts may differ. In addition to having your own, it is critical to understand your clients' billing policies. Make sure that policies are outlined up front so that you can present a bill that is compliant. For example, some clients may require a paper invoice and a longer time to pay than your standard billing terms. Knowing that in advance, will allow you to make the appropriate adjustments or negotiate the terms with your client before you bill. Client Friendly Process Remember your audience when preparing invoice. You may or may not know the client contact reviewing your bills. In some cases there may be multiple levels of review or invoices may be processed by a third party vendor. Avoid the use of industry jargon or abbreviations in your descriptions so that anyone reviewing will understand what is being billed. Track Your Time Even if you bill by the project or month, it is always a good idea to keep a record of time spent on client tasks. As a best practice always record your time immediately. This will ensure that your records are both up to date and accurate. You can track time using time and billing software, apps for your smartphone or even a simple notebook. The Invoice The detail of your invoice may vary by industry or client requirements but it is important to include:

To avoid billing conflicts, always have a signed agreement on file that articulates the billing process and terms. In some countries you are required to use the words "Tax Invoice." Be sure to confirm invoicing requirements with your local tax authority. Billing Methods When it comes to preparing professional invoices, you have a number of options. You can create a simple invoice template using Word or Excel. This is an easy, low cost process. Alternatively you can use time and billing software such as QuickBooks or cloud-based services such as Freshbooks or even PayPal to prepare and send client invoices. Many programs also offer apps that allow you to manage billing and payment from your mobile device. Banks and credit card companies today also offer invoicing services for their small business customers. Whether you choose to bill by paper or electronically, remember that every client touch point reflects your brand - including your invoices. Always present invoices that are accurate, timely and free of errors. As an independent consultant or contractor, you maintain sole responsibility for how much you earn. Your rate can be as high as what a client is willing to pay -- but finding out how much that should be is the tough part. The most important step is understanding the scope of the project and the needs, wants and urgency of the potential client. How do you calculate a bill rate that doesn't undersell your services or lose you the contract to another consultant?

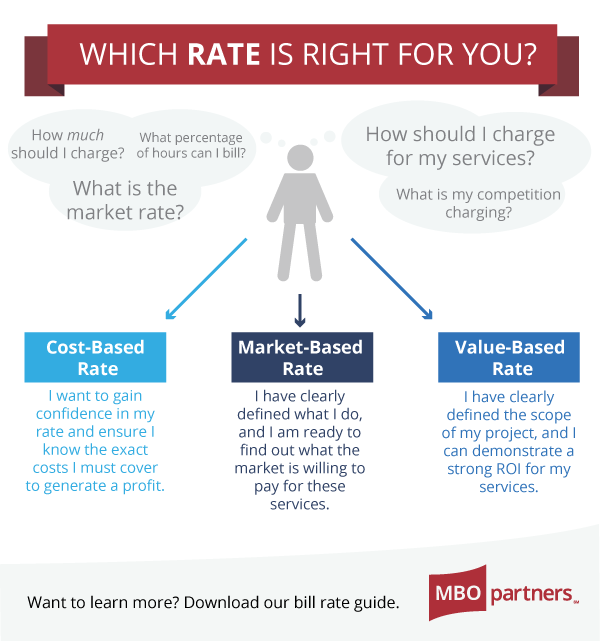

There are three main techniques used to calculate your bill rate: Cost-Based Rates This is the most common starting point for calculating a bill rate. It helps set your baseline or ‘equivalent W-2 number'. It factors in the costs you need to cover to make your target income. Although this is an ideal method for many consultants, it does have its drawbacks. First, it does not take into account the value you are providing the client, so this method could have you undercharging people. You also aren't factoring in what the competition is doing or charging or how urgent the client may need your services and how scarce of a resource you are to find. Market-Based Rates As you might remember from your basic economics class, the market rate is based on supply and demand. If your billing rate is market-based, you can assure that the amount will meet your client's expectations. In order to assign a market rate to your work, you must be performing a task that is definable - what do you do? Defining what you do can take into account your experience, industry, title, and region. You can also define what you do in terms of what you make or provide - website design, training sessions, etc. To accurately calculate a market-based bill rate, you must have current market data. Your best source of information is competitive research: who are your competitors, what do they offer, and how much do they charge? Value-Based Rates If you own the only gas station on a 300 mile stretch of highway, you'll be able to price pretty high. The same holds true for independent consultants who have a unique, valuable and scarce skill. The best way to determine the value is to know the client. Try and find out as much as you can about the projects scope to understand the value you can provide. Simply put, this bill rate is very specific to your client and your contribution. As you may have guessed, it's based on the value you provide to the client and the ROI they receive. This can be a very profitable billing method, but is only appropriate for consultants with a wealth of experience. The client must walk away feeling that they actually got enough value for what you were charging, or else your reputation will suffer. Your Strategy Whatever your strategy, you should review your rates often (at least annually). Summary As a business-of-one, you will incur fixed costs that cannot be billed back to a client. You also may need to take care of expenses that used to be the role of an employer, like health care expenses, retirement funds, etc. Each of these fixed or variable costs drain income, and managing them well can lead to opportunities to write off expenses against your income bringing more money back into your pocket. ** Properly managing business expenses is not just good business, but also a good income strategy for a solo professional. As a business-of-one, you will incur fixed costs that cannot be billed back to a client. You also may need to take care of expenses that used to be the role of an employer, like health care expenses, retirement funds, etc. Each of these fixed or variable costs drain income, and managing them well can lead to opportunities to write off expenses against your income bringing more money back into your pocket. Let's talk about the categories of expenses you should make sure you are accounting for. These are all areas you should make sure you are keeping records and receipts for either through a business process outsourcing partner like MBO, or via your own accounting strategy. Coming Right Back At You: Costs of Communications:

Pay Yourself Back for Learning On The Job: Tuition and Training Dollars

Put Those Meals and Entertainment On the Books: Business Development Dollars

Promotion Pays: Marketing and Advertising Expenses

Taking the Hit out of Healthcare: Expensing Private Insurance

Home Alone: Get the Benefits Of Buying & Maintaining Home Office Equipment:

Running A One Person Show: Misc Office Costs

Keeping It Above Board: Write Off Against Professional Fees

At MBO Partners, our business managers help our consultants properly track and account for these expenses and see the income benefit at each paycheck, not just at the end of the year. That's worth it for busy solo businesses, and sure beats a 12-month pileup in a shoe box. ** Article extracted from MBO Partners official website.

Get to Know MBO Partners MBO Partners has the industry’s only complete business operating system for independent workers, offering technology solutions that make it easy for self-employed professionals and their clients to do business. By re-envisioning and streamlining the entire contract talent acquisition and engagement lifecycle, MBO improves how independents operate and succeed while helping enterprises reduce risk and get the best return on their contractor investments. MBO is privately held. MBO fosters the same spirit of entrepreneurship at their company that they do for the independent workforce. Their purpose is to serve independent consultants. To learn more about MBO or to share ideas about America’s changing workforce, contact them directly. Leadership With 200 years of combined industry experience, the MBO Leadership Team is the backbone of our company. The core of the team has been together for more than a decade, comprising leading experts in the contract workforce industry. They are the movers and shakers, and as varied and unique as their strengths may be, they all share the same passion for the MBO mission. President and CEO, Gene Zaino, is the visionary who guides our company on its mission. An accomplished and nationally recognized expert in the contract workforce market, Gene launched MBO Partners to re-invent the way independent consultants and organizations work together. Intellectually diverse, battle-tested, and passionate, the MBO Leadership Team is leading the American workforce towards a bright future. Learn more about the team. Mission, Vision and ValuesMBO Partners exists to make it easier for self-employed professionals and their clients to work together. More and more people are seeking the freedom to be their own bosses and build their careers independently; we help them do that. MBO is a trusted guide for independent workers and the companies that hire them, leveraging our experience and our passion as the country moves toward the future of work.

Our vision is to see a majority of the workforce become self-employed. Being your own boss, setting your own hours and following your own dreams shouldn’t be reserved for the few. At MBO, we want to make this dream a reality for millions. Above all else, we value trust. Whether you are an independent, you engage independents, or you’re just looking to learn, MBO is committed to being honest, factual and objective. We pledge to be responsive, empathetic, and fair, delivering success where we can and working to improve when we can’t. We are problem solvers who believe that research and knowledge provide value to our customers. Call us; we can answer your questions and provide you with valuable information. We employ experts in independent work who specialize in finance, labor laws, and technology, and if we can’t find your answer, we’ll find someone who can. We believe that to make career independence possible, people need a guide they can trust as they take that bold leap. Price-Waterhouse put together a new website aimed at identifying independent consultants in different areas of expertise for their high profile projects.

The PwC's Talent Exchange is offered as a first of its kind tool and work as a large, broad job board looking for staffing projects in the segments the company works on. Below I selected information from their website to explain the tool's benefits and process. The Talent Exchange is a first-of-its kind marketplace that connects top independent talent, like you, with exciting opportunities at PwC. It is a place where you can learn about open roles with PwC, network with PwC employees and gain support to continue building your career. More than just staffing you on a project, PwC are looking to establish a relationship where you will continue to be considered for roles that match your skills and experience. Through the Talent Exchange, PwC is pioneering new ways for you to connect with our engagement teams to deliver distinctive, high-quality service to our clients. MEMBER BENEFITS Opportunities to work on high profile projects and interesting challenges that position you to make a difference for leading brands worldwide. Greater transparency into proposed project pipelines, timing and even market pricing. A single, integrated platform that facilitates the project lifecycle from searching for open roles, to joining a project, to submitting hours and expenses, to networking. IT JUST GOT EASIER TO FILL YOUR PIPELINE with interesting work STEP 1: Tell us about yourself. Share your skills, your availability and your preferences for things like travel and rate. We’ll use this to connect you with the open roles that best fit when, where and how you like to work. STEP 2: Meet your match. Open roles that best match your profile and preferences will be sent directly to you – or you can search the marketplace for roles that meet your interests and experience. STEP 3: Get to work. Let’s do great work together – helping to solve our clients' most important problems and achieve the extraordinary. STEP 4: Keep us up to date. Log into the Talent Exchange any time to update your experience, qualifications and availability. We’ll continue to connect you with the open roles that best fit what you are looking for. EXPLORE FOCUS AREAS tailored to your expertise To help you connect with the roles that fit you best, we’ve created Focus Areas. On the Focus Area pages, you can align yourself with your area of specialization, explore sample roles and subscribe to receive emails about new roles that match your interests. Over time, we’ll add opportunities to network as well as learn from new content and thought leadership. We're starting with six areas but will be adding more soon. Select a Focus Area below or read more about how they work. FOCUS AREAS Talent Exchange Focus Areas are where you can learn more about projects at PwC within your area of expertise. Subscribe to receive emails about roles, read about the types of projects we regularly have available and find out how our members are helping to solve interesting problems for our clients. Over time, we’ll also use this space to provide opportunities to network as well as share new content and thought leadership. Follow the Focus Areas relevant to your experience and be the first to hear about role. Sign up to become a full member of the Talent Exchange and you'll also receive the following benefits:

APPLICATION TECHNOLOGY CYBERSECURITY FINANCE OPERATIONS FINANCIAL SERVICES RISK AND REGULATORY MANAGEMENT FRAUD, INVESTIGATIONS & REGULATORY ENFORCEMENT GUIDEWIRE INFORMATION MANAGEMENT AND BIG DATA OPERATIONS ORACLE PROGRAM AND PORTFOLIO MANAGEMENT SALESFORCE SAP USER EXPERIENCE SEEKING TOP INDEPENDENT TALENT like you PwC are looking for independent talent who are both located and authorized to work in the US without sponsorship. Whether you have just a few years of experience or are a seasoned senior executive, our marketplace gives you unprecedented access to exciting and challenging PwC opportunities. From developers and program managers, to specialists with deep industry or functional subject matter knowledge, to C‑suite executives and thought leaders, we have a place for you in the Talent Exchange. While looking for options for a current customer project, I came to the article I am copying and pasting below in this post. This excellent article was published May 8th, 2017 by Rachel Burger in Project Management. Rachel tackles the topic in a very objective manner, using her actual business problems as example to talk about why an independent consultant or freelancing professional would need a time tracking tool and further. An important rationale for our benefit is the critical factor of the invoicing and billing process. While I already superficially mentioned accounting tools (Quickbooks On Line or GoDaddy for example), being able to also track your most important money making engine (your hours) and through this tracking to accurately invoice your customer comes to be the maker or breaker for your operation. Please note Rachel's remarks on this, she makes a great point when exemplifying the chaos of our daily routines and the challenge that is to reflect the time we actually worked on a project and not necessarily only the time we showed up in front of the customer. 8 of the Best Free Time Tracking SoftwareAt my first job, I worked as a research underling for a small HR consulting company. As tends to be the case with consulting, we billed clients on an hourly basis.

Of course, this was my first job, and I had no idea how to accurately track my time. I was used to campus hourly work, where you got compensated based on whether you showed up, not based on the amount of time you spent working on a specific project. Getting used to time tracking was tough for me. In my creative process, I tend to have tabs upon tabs open. As someone who is chronically struggling with the battle between ADD, creativity, and getting things done on time; as someone who flips between Facebook, Hangouts, work email, and expense reports; and as someone whose attention span fluctuates (often forgetting to stop or start the time tracking button), calculating my hours was an optimistic dream at best. Then again, we were relying on tools that didn’t facilitate the time tracking process well. We used Trello to track our projects and wrote in our hours worked on the kanban cards. That meant that we used another free online application with simple “start” and “stop” buttons and that we had to record each time we worked on a project. For me, that meant hunting through tabs and remembering to comply with time tracking altogether. It was, in short, a disaster. Since entering the project management software world a few years ago, I realized that my old job was suffering from a lack of quality business tools. Yes, what they were using was free, but there is also free time tracking software that’s better than the system we had. So I went on a hunt. I looked through the time tracking apps that:

After filtering through 500 or so time tracking applications in Capterra’s directory, these eight stood out in the areas that I was examining. Not every business will fit every solution offered here, though. Take the time to compare features and pricing, and let me know in the comments if I missed any big winners! These time tracking apps are sorted alphabetically, as their features vary enough that there isn’t a clear “best” or “worst.” 1. AccountSight 2. Due.com 3. Hubstaff 4. Ronin 5. Tick 6. todo.vu 7. Toggl 8. Trigger ** please note that in her article, Rachel provides a full thorough review of each of the tools she mentions, listed in the above list While looking for opportunities to strengthen my pipeline, I usually look for new tools, platforms or sites (new for me, meaning those tools I am not familiar or have not worked with before). I came to know the LinkedIn Profinder tool, offered by the largest professional social network. It is interesting, and from my own interpretation, how many independent consultants, freelancing professionals and companies looking for those professionals started to use LinkedIn to staff their projects. My conclusion is that creating that tools was a natural step for the site. Below is a copy and paste from their overview. LinkedIn ProFinder is LinkedIn's professional services marketplace that helps you find the best freelance or independent professionals in your area. It's currently only available within the U.S. and within specific service categories. We aim to get you up to five responses from highly qualified, local professionals within 24 business hours of your request submission. Currently, LinkedIn members from any valid U.S. zip code can file a request for a service. If you're a freelance or independent professional, learn how you can apply to be a service provider on LinkedIn ProFinder and our five keys to a successful LinkedIn ProFinder profile. Use of LinkedIn ProFinder is governed by the LinkedIn User Agreement, LinkedIn's Privacy Policy, and the ProFinder Terms and Conditions. Intro for ProsWith LinkedIn ProFinder, quality, vetted leads will come directly to you. Learn how to apply to be a professional service provider and get started with ProFinder. Applying to be a Professional on LinkedIn ProFinderIf you're a freelance professional wanting to be a pro on LinkedIn ProFinder, follow these steps to applyto be a service provider on ProFinder. Notes:

Getting LinkedIn ProFinder LeadsWhen a consumer submits a project request, the project is distributed via the LinkedIn ProFinder algorithm. The algorithm considers the following criteria when notifying pros of leads:

Pros can receive email notifications when the ProFinder system determines that they are a good fit for a new project request. Learn more about how to adjust your email preferences to receive email notifications. In order to view all the project requests that are available in your area at any given time, be sure to check your Client Requests folder regularly. Any projects listed as Available are still open to accept proposals and are first come first served. LinkedIn ProFinder - Keys to a Successful ProfileLinkedIn ProFinder is a marketplace that connects top quality freelance or independent professionals with new clients and leads. Having a fully complete profile is the most important piece to getting opportunities, as it's one of the first things potential clients will see. There are five main pieces to consider when building a successful profile:

Viewing Project Requests on LinkedIn ProFinderTo view your LinkedIn ProFinder project requests, you'll need to log into your ProFinder account and click Client Requests in the upper right corner of the page. You'll see a list of all proposals that have been matched to your services. Pros will be notified of new projects via a drip model. That is, when a project is approved by our team, pros will be notified in small batches until the project request fills with 5 proposals or a 48-hour window has passed, whichever comes first. Pros will receive email alerts for all projects they are eligible for within their geographic radius. Pros will receive email alerts for projects that are a good fit for the services they offer, otherwise all project requests available in their area will be visible in the Client Requests folder. We recommend checking your Client Requests folder multiple times per day. If you're not receiving emails for project requests, be sure to check the spam folders in your email. Learn more about ProFinder email notifications. Writing a Quality Proposal to a Client on LinkedIn ProFinderHere are some tips for writing a great proposal within LinkedIn ProFinder so you're more likely to hear back from a client who is looking to hire professionals like you.

There are a few things to keep in mind when writing your proposal:

|

The AuthorI dedicate my life to science, technology, music and to bringing people together. And I do it my way. Archives

November 2023

Categories

All

|

RSS Feed

RSS Feed